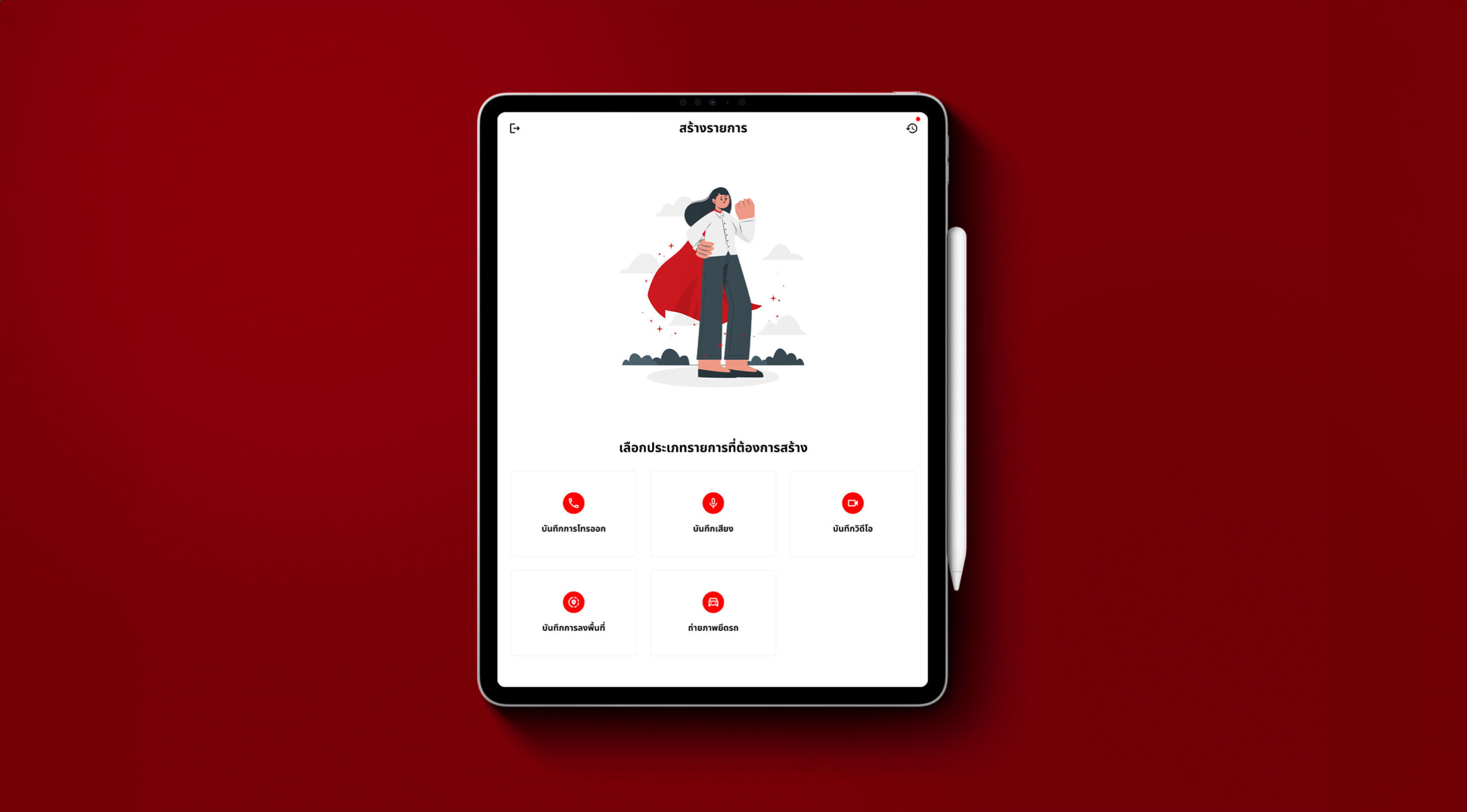

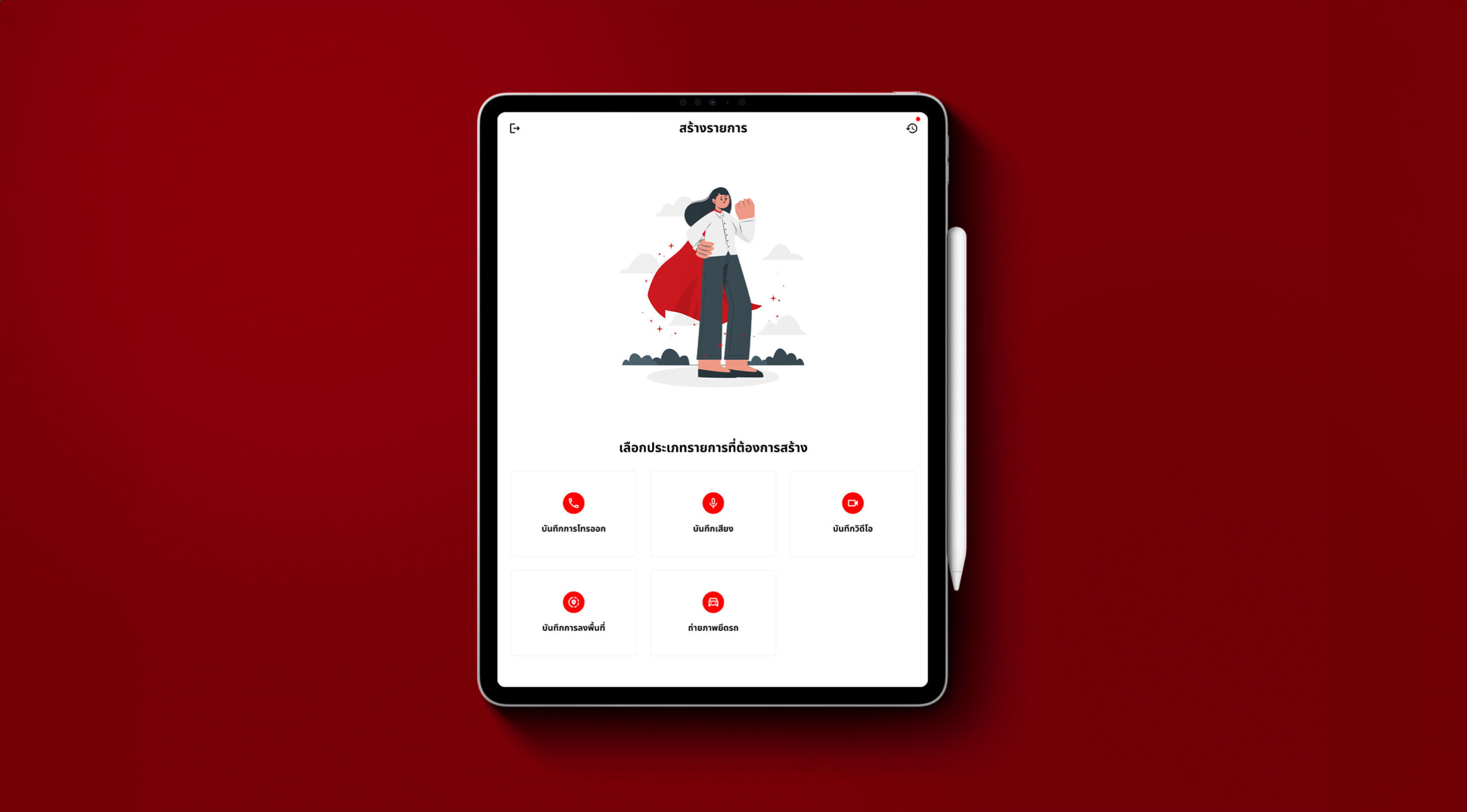

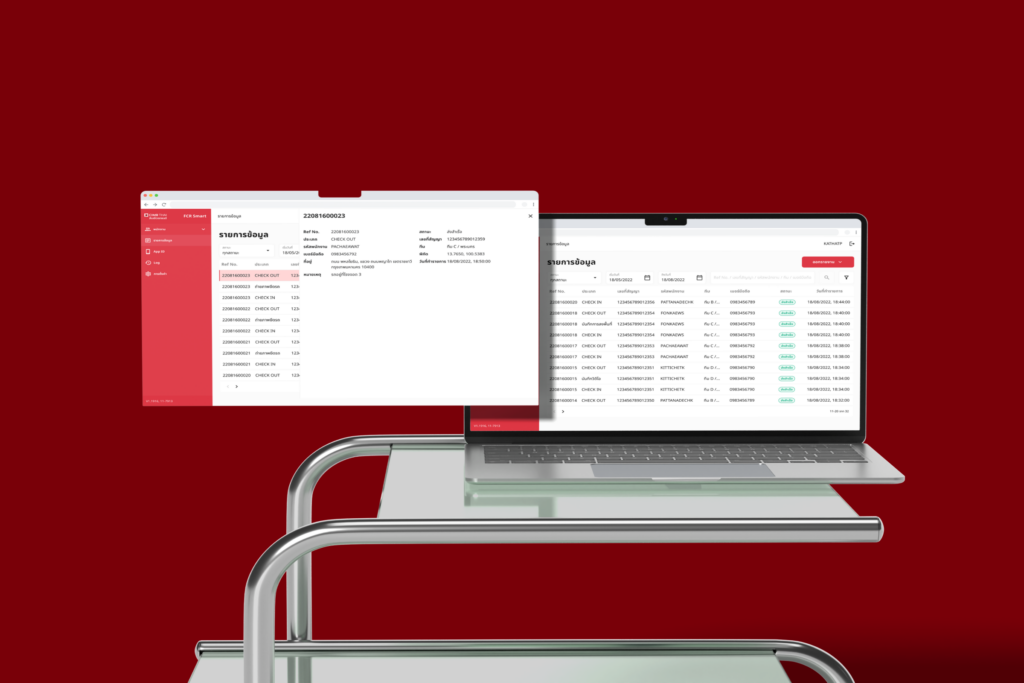

D-Debt

Application for managing and collecting car debts efficiently

Project:

CIMB Thai Auto Application

Year:

2022

Goals:

Efficiently manage and monitor car debt.

Link:

–

Description:

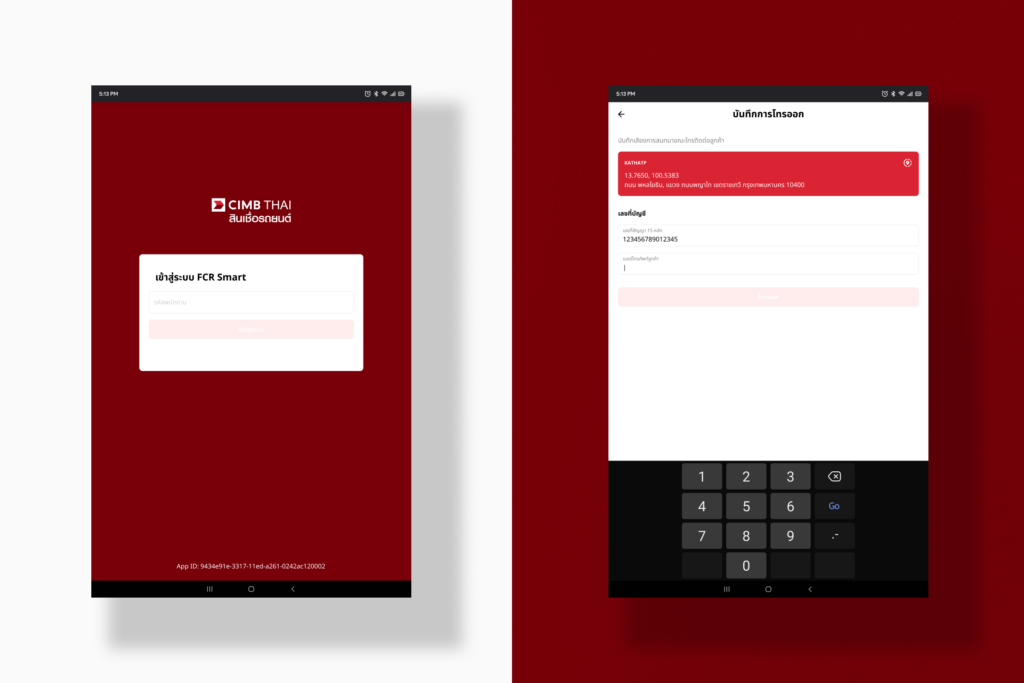

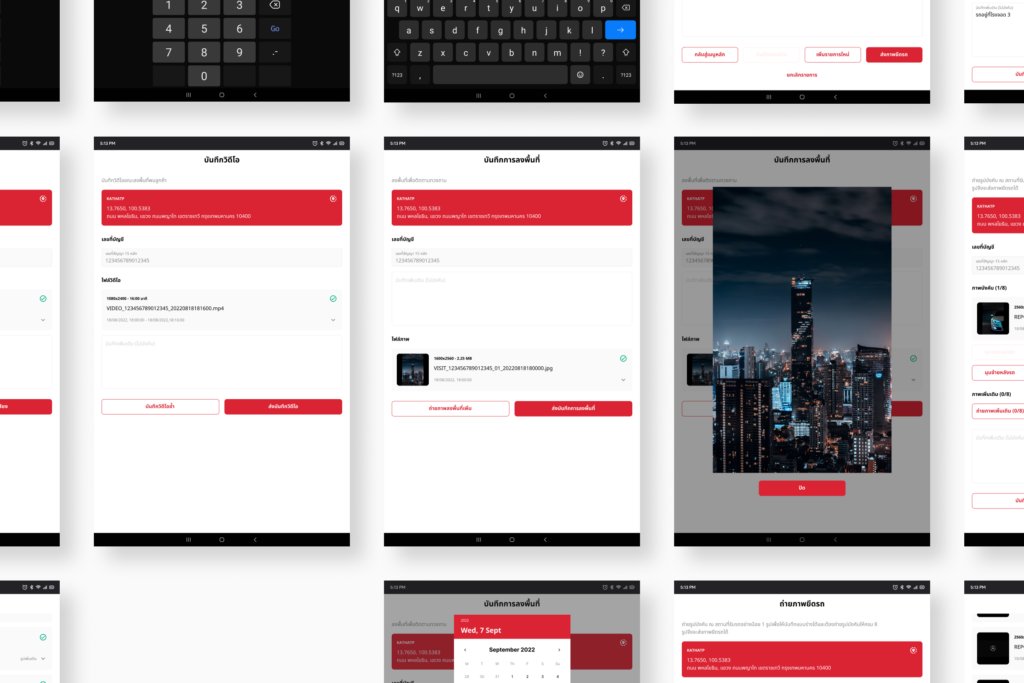

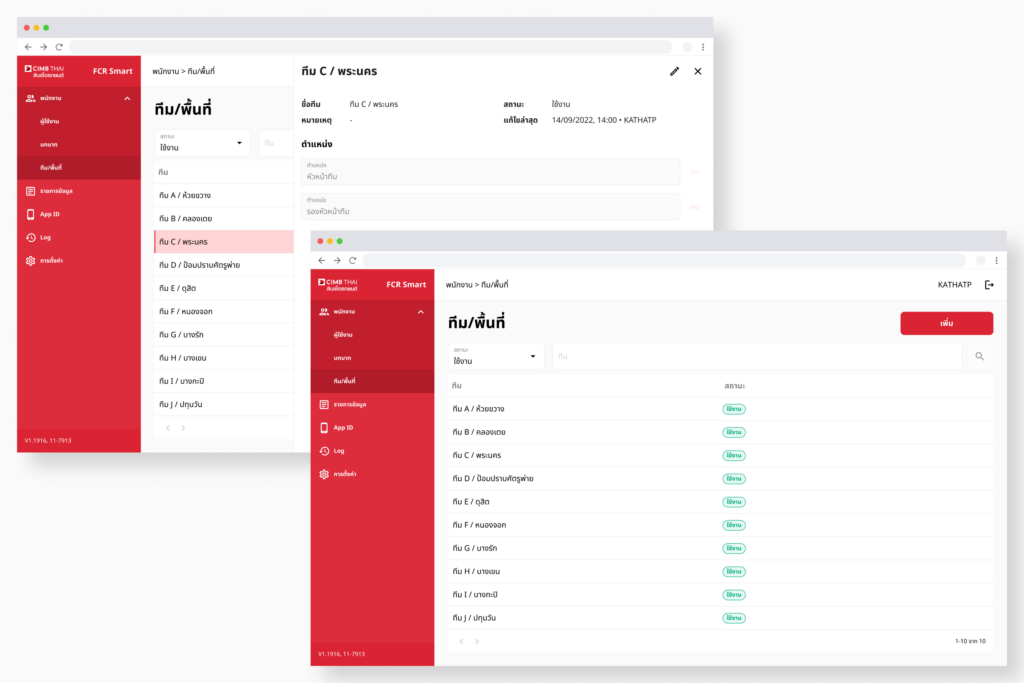

D-Debt is a debt management system developed by JIB Soft to support businesses in streamlining their debt collection and management processes. The system is designed to provide an organized, automated approach to handling outstanding debts, tracking payment statuses, and communicating with debtors. By incorporating customizable alerts, reminders, and payment tracking features, D-Debt enhances operational efficiency and helps reduce delinquency rates.

Goals:

1.To automate and streamline debt management and collection processes.

2.To reduce overdue accounts through timely reminders and notifications.

3.To improve transparency and accuracy in tracking payment statuses.

4.To enhance customer relations by offering a clear and organized approach to debt communication.

Problem:

Many businesses face challenges in managing large volumes of overdue accounts, resulting in missed payments, inefficient follow-ups, and an overall strain on resources. Without a structured system, debt management can become disorganized, leading to cash flow issues and potentially damaging customer relationships.

Proposed Solution:

JIB Soft developed D-Debt as an end-to-end solution for debt management. The system automates the tracking and collection of outstanding debts, allowing for scheduled reminders, personalized messages to debtors, and a transparent payment history for each account. The software also provides analytics and reporting features, helping businesses monitor collections performance and improve cash flow. By standardizing debt management processes, D-Debt reduces the workload on accounting and collection teams while minimizing human error.

Business & Users:

- Business: D-Debt is beneficial for businesses across various industries that handle accounts receivable and debt management. It helps organizations increase recovery rates, reduce overdue payments, and improve cash flow through efficient debt tracking and timely collection efforts. Additionally, D-Debt’s analytics empower business leaders to make informed decisions on debt strategies.

- Users: Primary users include the accounting, finance, and collections departments, who can manage debt portfolios more efficiently. End customers also benefit, as D-Debt provides clear communication about outstanding payments and deadlines, creating a structured approach to debt management and improving overall customer relations.

D-Debt optimizes debt management processes for businesses, ensuring faster collections, better financial oversight, and a systematic approach to maintaining cash flow stability and customer trust.